A SAVVY saver has revealed a simply salary bucketing method that helped her clear £4000 worth of debt.

Popular TikToker @yoitsdevvie regularly shares finance tips with her fans, including her "5 fund method".

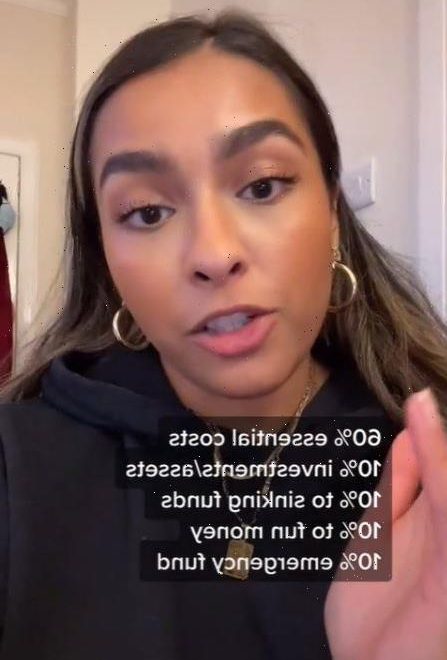

In an interesting and informative video, she began: "Here's the budgeting method that I used that got me out of thousands of pounds of consumer debt in two years."

She said she split her monthly salary into five parts – 60% for essential living cost, 10% for sinking fund to pay off her debt, 10% for investments and asset building, 10% for fun money and 10% for an emergency fund.

The TikToker also mentioned that the distribution is flexible and individuals should adjust the percentages according to their own situation.

For example, she said if you have a bigger amount of debt and can't afford to invest yet, the 10% for asset building should go towards clearing the debt first.

Experts say having separate pots of money to pay each bill or expense can help people keep track on their savings, as well as paying their debts.

"You can set up standing orders to transfer those percentages straight out of your account every month and the work is being done for you," the finance enthusiast added.

Most read in Money

MONEY SHOCK

One million families to lose thousands within WEEKS due to extra benefit charge

Impressive £1.7m home hides a very bright secret in every room

I'm a supermarket expert – here's how I fed a family of four for just £38 a week

Thousands on Universal Credit could avoid payment cut under benefit rule change

"This method works really well if you have different accounts for each of the percentage bucket."

Many banks now provide customers with this feature, including challenger banks such as Starling and Monzo as well as high street banks.

The TikToker said she has a standing order from her current account to Monzo, which she then then splits into pots for her sinking fund and fun money.

Sinking funds are a really common tool used by savers to achieve their saving goals.

Though "sinking" might sound negative, the term was made for companies or people paying off debts and bonds, so the word "sinking" is used in reference to the sinking – or lowering – amount of debt.

Now, many people use the term to describe the way they set aside their money for specific expenses.

What free money management apps are available?

BUDGETING apps connect electronically to your bank accounts to keep a track of what you're spending and what on.

They let you see your money across multiple accounts in one place, making it easier to make sense of.

Many of them are available for free. Here are our top picks:

- Bean – Best for tracking subscriptions

This app reckons it can save you £672 a year by tracking your subscriptions, like Apple Music, Netflix and Spotify, and alerting you to better deals elsewhere. You can also cancel any that you don't use through the app.

- Emma – Best for viewing extra charges

It includes a feature that lets you see how much you're forking out on unnecessary fees, such as overdraft charges, foreign transactions, refused diret debits and lat payments.

- Yolt – Best for managing multiple accounts

This app lets you easily move money between accounts from the app, rather than having to log in to online banking every time you want to make a transfer.

- Money Dashboard – Best for viewing your transactions

You can view all of the transactions you've made from each bank account in one place. It also splits the payments into different categories so you can identify where you can make cuts.

There are also lots of budgeting apps which you can connect to your bank accounts.

Apps like Chip, Plum, Cleo and Tandem use clever technology to work out how much you can afford to save and then automatically move money from your bank account into a separate savings pot.

However, budgeting isn't the only option you have in order to pay off debt. There are other ways that can help you gain control on your finance strategically.

One popular approach – the avalanche method – encourages people to focus on the debt with the highest interest rate first.

On the other hand, the snowball method asks people to start with paying off the smallest debts.

You could also opt in for a hybrid method, mixing in a bit of both.

Previously, a budgeting expert revealed just how many bank accounts you should have to achieve your financial goals and bills.

Here’s a quick guide to some simple tips you can use to detox your finances and pocket almost £4,500 in a year.

Plus, we round up five budgeting apps that let you keep an eye on different accounts in one place.

We pay for your stories!

Do you have a story for The Sun Online Money team?

Email us at [email protected]

Source: Read Full Article