CRYPTOCURRENCY investors may be aware of a major update to Ethereum dubbed the "London hard fork".

We explain when it'll come into effect and how it could affect the value of Ethereum.

Before you invest, if you haven't already, keep in mind that making money through cryptocurrencies is never guaranteed.

Instead, you may actually lose all the cash you put in so don't invest more than you can afford to lose or into anything you don't understand.

Cryptocurrencies are especially volatile, so their values can make large swings with no notice.

There's also scant regulation for cryptocurrency firms, so you won't have protection if and when things go wrong.

5 risks of crypto investments

BELOW we round up five risks of investing in cryptocurrencies.

- Consumer protection: Some investments advertising high returns based on cryptoassets may not be subject to regulation beyond anti-money laundering requirements.

- Price volatility: Significant price volatility in cryptoassets, combined with the inherent difficulties of valuing cryptoassets reliably, places consumers at a high risk of losses.

- Product complexity: The complexity of some products and services relating to cryptoassets can make it hard for consumers to understand the risks. There is no guarantee that cryptoassets can be converted back into cash. Converting a cryptoasset back to cash depends on demand and supply existing in the market.

- Charges and fees: Consumers should consider the impact of fees and charges on their investment which may be more than those for regulated investment products.

- Marketing materials: Firms may overstate the returns of products or understate the risks involved.

What is the Ethereum ‘London hard fork’ update?

Ethereum was released in 2015 and is currently the second largest cryptocurrency behind Bitcoin, which launched in 2009.

As well as being used as a cryptocurrency, developers can also build applications and run smart contracts on Ethereum.

The upgrade is technically called Ethereum Improvement Protocol 1559, or EIP-1559, but it has also been named the "London hard fork".

Currently, network users bid against each other to have their transactions confirmed on the blockchain by miners.

It means you'll generally have to pay a higher gas fee during busy times, which is good for miners but bad for users.

Under the change, this process will instead be handled by an automatic bidding system with a set fee amount based on how busy the network is.

These fees also won't be going to the miners anymore, but to the network itself, meaning they're effectively burnt and removed from circulation.

When is it happening?

The upgrade is set to take place today, at 8.30am Eastern Time, according to a countdown on the Ethereum website.

For investors in the UK, this means the time will be 1.30pm.

Will the price go up?

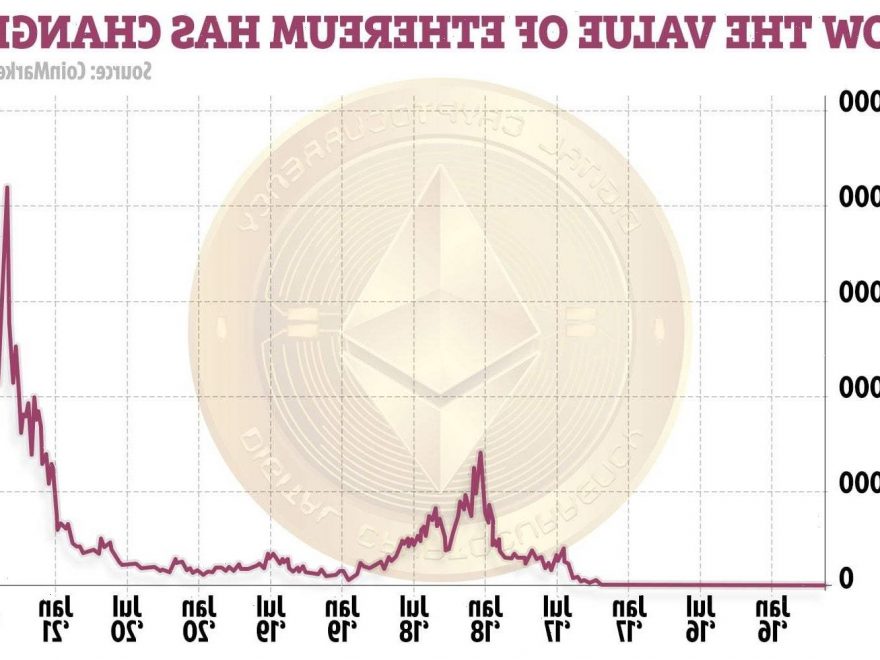

At the time of writing, the price of Ethereum is currently $2,606 – up by 5% over the past 24 hours, according to CoinMarketCap.

In comparison, it hit its highest ever level on May 11, when it reached $4,168.70.

Whether the price of Ethereum will rise following the upgrade remains to be seen, and it depends on several factors.

As always, Ethereum, like any cryptocurrency, is also always affected by the wider market and announcements by regulators and celebrities alike.

Simon Peters, cryptoasset analyst at eToro, told The Sun: ""A smooth transition could be supportive of the price as the fork would be judged to improve the token economics of Ethereum by helping it to become less inflationary.

“Ethereum could theoretically become deflationary if the transaction volume on the network is high enough that the amount of Ethereum being burnt is greater than the new supply coming into circulation via block rewards.

"In turn, if the demand for Ethereum is higher than supply the price could rise too."

However, he added: "Investors should always do their research and judge their decisions on the merits of the asset they are considering, and not be swayed by short-term price movements."

Meanwhile, Myron Jobson, personal finance campaigner of Interactive Investor, added that the reduction in supply is hoped to boost the price.

This can be compared to past Bitcoin halvings – where the block reward to miners is cut in half – and has boosted its price previously.

However, Mr Jobson added: "The same won’t necessarily happen with Ethereum.

"In fact the response is likely to be muted until the impact of the changes filter through."

The values of Bitcoin and Ethereum fell in May after China announced a further crackdown on cryptocurrencies.

We reveal how scammers are using influencers on Instagram and TikTok to dupe crypto investors.

Meanwhile, the founder of Ethereum recently became the world's youngest crypto billionaire at the age of 27 after it surged in value.

Source: Read Full Article