TRAVEL insurance varies greatly in price and cover – we explain the cheapest policies available and what protection they give you.

Holiday cover is important as it can help repay you if flights or hotel bookings are cancelled or you need to go to hospital while abroad. Here is how to find the best cheap travel insurance for your needs.

The coronavirus outbreak in 2020 showed the importance of travel insurance as many holidaymakers had to claim for cancelled trips.

Many also found they weren't covered for disruptions as their policy may have excluded epidemics and pandemics.

This shows the need to check what you are actually getting when finding the best holiday insurance for you.

What should you look for in a good travel insurance policy?

- Medical expenses – A good policy will give cover of £1million or more for travel in Europe and £2million or more for the USA

- Repatriation service – The costs of getting you back to the UK for medical reasons should be covered automatically by your policy

- Cancellation and curtailment – A good policy will cover you for £2,000 or more if you have to cancel or shorten your holiday

- Missed departure – Covers additional accommodation costs and travel expenses up to £500 or more if you miss your flight due to circumstances out of your control

- Delay – You'll usually be covered for £250 or more if your travel plans are delayed due to circumstances out of your control

- Baggage cover – Covers you if your baggage is lost, damaged or stolen. Look for policies that have cover of £1,500 or more.

What is travel insurance?

Just as car insurance can help pay to fix you car if it was in an accident, travel insurance is there to help you when something goes wrong with your holiday.

It helps cover you if something goes wrong when travelling abroad and without it you could be left with hefty medical or travel bills.

There are two main types of travel insurance, single and multi-trip cover.

If you're lucky enough to be having at least two holidays in a year, then it can often work out cheaper for you to take out annual multi-trip cover instead of a single policy for each trip you take.

If you are buying an annual policy, make sure you know how long you can be away for on each trip.

Although you'll get cover for an unlimited amount of trips, some insurers will cap the amount of time you can be on holiday for, usually around 31 days.

If you're planning on being away for longer than that on a backpacking trip, you'll need to look at specialist backpacking insurance – also known as “long stay” cover.

What does travel insurance cover?

You can pay for cover that protects you for a range of scenarios.

This can include if your luggage has been stolen, if you need to cancel your trip, or if you need medical treatment while abroad.

The NHS doesn't follow you abroad on holiday, so if you break a leg or become ill you may need to pay for a hospital stay.

If these are included in your insurance policy, you won't be left out of pocket if your holiday is spoiled.

You may still have to pay upfront for something like medical treatment and claim for the money back later on your insurance.

Travel insurance may also cover you if your hotel closed and you had to move accommodation, or if your flight was cancelled and you are unable to get your money back from the airline.

The product doesn't just cover you while you are abroad, but can also provide protection if you have to cancel because of an illness, redundancy or a close family bereavement.

Check the small print of your policy thoroughly to check what you are covered for.

All policies have different inclusions and exclusions, so you'll need to a bit of research to make sure it offers you the right level of cover.

For example, cover for lost or stolen bags might be an additional extra, which you'll have to pay more for with some policies.

Generally there are a few things that aren't always covered.

Adventure and winter sports can be added to several policies but usually this doesn’t come as standard.

Likewise, if you’re going on a cruise there is specialist cover available but this will need to be selected or added when you’re getting a quote.

Cover for events such as strikes, acts of terrorism and earthquakes are also typically excluded.

If you're over 65, or have an ongoing medical condition, there might be some more questions you need to answer when getting a quote.

Numerous providers cater for people with medical conditions and the MAPS (Money And Pensions Service) has introduced requirements for a specific medical directory to be available for customers if they do have extreme medical conditions.

This service provides a list of providers who specialise in catering for those with conditions where a standard travel policy may not be appropriate.

When looking for cover make sure you answer the questions about your health honestly – otherwise you risk invalidating your policy.

Does travel insurance cover Covid?

Many insurers initially stopped selling policies to new customers at the start of the coronavirus outbreak in March 2020 as cover for pandemics or known events that may disrupt your trip are typically excluded within every policy.

This meant they would be at risk of mis-selling as at that time there was no end date in sight for the pandemic.

There are plenty of risks when travelling during a pandemic.

There may be a lockdown at your destination so you can't leave or need to go home earlier.

You may no longer be able to travel if you are told to self isolate or if the government bans international travel.

Holidaymakers can get travel insurance now but the level of Covid cover varies, although several providers do offer it.

Not all policies will cover you for Covid-related disruption such as if you have to self-isolate, can no longer travel or are stuck abroad for longer and need to pay for hotel stays.

Most cover coronavirus-related medical and repatriation costs, or you could get protection if you get coronavirus and have to stay home.

Others may also payout if you have been ordered to self isolate so need to cancel your trip, or if government travel advice changes.

You can check policy terms and what is included and excluded before you pay for cover. There is often a one page summary but it may be worth reading the full policy and checking with a provider's customer services department so you don't miss anything and aren't left out of pocket.

Will travel insurance cover cancellation?

All travel insurance policies differ but cancellation cover is often one of the standard features.

There are plenty of reasons why your trip may be cancelled and most insurers will cover you if you have been in an accident, fall ill, your home is damaged by fire or flood or your destination has become unsafe.

You can also be covered if you have jury duty or a bereavement for a close family member.

Insurers may also cover you for cancelled flights although you’ll likely be asked to claim from your airline first.

If you do have cancellation cover in your policy, it will usually payout for cancelled travel tickets including planes, trains and transfers as well as pre-booked accommodation and any excursions.

If you have booked via a package holiday provider, then they should be your first port of call rather than your insurance policy.

There will be a maximum limit that you can claim for and the higher the amount, the more you’re likely to pay for the insurance.

Check your policy features before buying to understand what is covered though.

For example, policies would not cover cancellations during the coronavirus pandemic if restrictions meant people were not legally allowed to travel and chose to do so.

This is because insurance is typically for unforeseen circumstances and exclusions exist in policy books if your holiday is cancelled due to known event.

How much is travel insurance?

The amount you pay for travel insurance is known as the premium.

This is determined by several factors that will influence how easy it is to get cheap travel insurance.

When you are shopping around for travel insurance, an insurer will want to know the ages and medical conditions of anyone travelling.

You will also be asked where you are going and how long for, as well as the maximum value of your luggage, flights and accommodation that you would like covered.

All these factors will be considered when a policy is priced.

The calculation will be based on how long you are away for, where you are travelling to, how likely the insurer thinks you are to make a claim and the cost of medical treatment at your destination.

It will also depend on how much excess, the charge for if you have to make claim, you are willing to pay.

Generally, the higher your excess, the lower your premium will be.

Insurers will let you pay a lump sum or monthly. Paying on a monthly basis helps spread the payments but there may be an extra fee which will push the price up.

What does "excess" mean in travel insurance?

The excess is the amount you pay an insurer when you make a claim.

It is your contribution towards a claim and can either be deducted from a payout or paid separately.

For example, if you claimed £700 for lost luggage and had a £200 excess then you would get £500 back.

You can set the amount of excess you would like to pay when shopping around for travel insurance.

The higher the figure, the lower the actual cost of your insurance – known as the premium – will be.

There are some policies that have no excess but will typically be more expensive.

Also, check what the excess covers with your insurer.

It may be charged per person regardless of the number of claims, or for each incident or policy category.

For example, if you claimed for a lost handbag and flight delay, you would pay the excess once if it was per person and twice if it was per incident.

Will any policy cover me if I am travelling for more than a month?

Most travel insurance policies have a limit on how many days in a row they will cover you for.

This is typically around 31 days even if you have a multi-trip policy.

Each trip can't be longer than 31 days.

If you need cover for a longer period, such as if you went backpacking for a year, you would need to get long-stay cover.

This can provide insurance for more than a month and often up to 18 months.

Could drinking alcohol invalidate my claim?

There is nothing wrong with sipping a cocktail or a cold beer as you relax by the pool on holiday. But if you end up getting drunk and as a result fall ill or get injured, your travel insurance policy may not cover you for treatment.

Being under the influence of alcohol can invalidate your insurance claim.

Check your policy terms for exact exclusions.

This doesn't stop you from having a drink but you must behave responsibly as you should when at home.

Does travel insurance cover pregnancy?

Fitting in a final holiday before having a baby can be a great time to relax before the nights of lost sleep begin.

You don't have to declare that you are pregnant when taking out insurance as it isn't a medical condition.

However, you may have to declare if you have pregnancy-related issues such as high blood pressure or gestational diabetes.

Insurers typically payout for pregnancy-related issues up to 38 weeks but check your policy as levels of cover vary.

You can also get specialist insurance that has broader pregnancy coverage if you want peace of mind.

A top travel insurance policy for pregnancy would cover hospital bills if you need medical attention while abroad, or have an early birth or emergency c-section.

This may also include additional expenses if you give birth abroad, such as delaying your flight home.

Can I get travel insurance against Foreign and and Development Office (FCDO) advice?

Generally, if the FCDO advises against all but essential travel to a country, then you would not be covered by travel insurance if you still made the journey, even if you are travelling for essential purposes.

Some providers do now offer cover for essential purposes but not many so keep an eye out for this when comparing quotes.

The FCDO regularly updated its guidance during the coronavirus pandemic.

This meant countries could become unsafe at very short notice impacting those planning to get away and forcing some holidaymakers back early to avoid upcoming quarantine restrictions.

As the pandemic was a known event, if customers were booking holidays that were then cancelled due to Covid making the destination unsafe, it was highly likely any claim would be declined as this was a known risk when booking .

But some may still need to travel to certain destinations despite FCDO advice such as for business or if you are covering high-risk warzones as a journalist, medic or humanitarian worker.

There are some specialist providers that offer this type of cover and more providers are starting to introduce cover if you are travelling for legal, essential purposes.

How to claim travel insurance

Your insurer will have a dedicated phone line to call when you need to make a claim.

Several providers have also improved digital claims systems due to the pressures of the pandemic.

The details will be given to you when you first buy the policy.

Take the policy number and contact details with you on holiday, as it is recommended to check if you are covered and to make a claim as soon as possible.

There may also be a time limit to make claims within.

Check your policy document and directly with your insurer to confirm if your claim is covered.

They will then send you a claims form or you may be able to download online.

Keep all documents and receipts, as an insurer will ask for proof if you are claiming for cancelled flights, delays – or if you had to buy new clothes as your luggage was lost or stolen.

If you need medical treatment when abroad it is best to contact your insurer first, to check that you are covered and to get them to agree to treatment.

You would often still have to pay first so keep any bills or receipts to get a refund.

There is no set time for how long it takes for your claim to be reviewed and this can depend on the provider and how busy they are.

Your insurer may also ask if you have tried to claim direct from the travel company, or through your credit card first as this may be quicker.

If you are rejected, you can appeal the decision and complain to the Financial Ombudsman Service if you are still unsatisfied.

Where can I get cheap travel insurance?

Travel insurance can be purchased from travel agents and holiday companies when you book, but there is no obligation to take this.

Banks, supermarkets and insurance companies also offer travel cover and a comparison website can help you find the right product for your needs.

You will need to provide the names and ages of all travellers, the destination and any medical conditions.

Results can then be filtered based on the level of cover and the excess you want to pay.

You can also sort policies by price to find cheap travel insurance but check what is covered, as the lowest-cost deals may not always provide the best protection.

It may also be worth using an insurance broker if you have more complex needs. You can find a regulated insurance broker on the British Brokers Association website.

Also check your current account as some banks may offer travel insurance automatically to their customers.

You should still check what is covered as this type of travel insurance usually has low levels of cover.

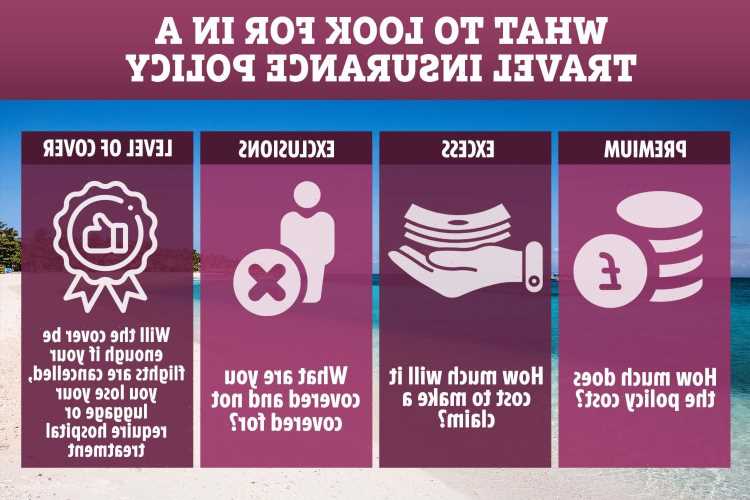

What to look for in travel insurance?

Getting the right cover and level of protection is vital when shopping around for the most suitable and cheap holiday insurance.

The best travel insurance should cover medical expenses, accidents, lost or damaged items and delays.

Policies should also payout for cancellations and missed flights as well as if you need to return home early due to an emergency.

Check the amount of cover before taking out your policy to ensure you have the right level of protection for the value of your flights and baggage.

The higher the level of protection, the more you will pay for your insurance although this can be reduced with a higher excess.

You may need specialist insurance or to add cover on top of your standard policy if you are going on a cruise, skiing or if you have a medical condition.

When to buy travel insurance

Buying the best travel insurance for your needs should be the first thing you do after booking your holiday.

You will need to tell your insurer when you are travelling, but if you buy straight away you are protected before you have left.

This covers you if you need to cancel your trip in advance.

Can I cancel travel insurance?

As with any insurance policy, you have a right to change your mind within the first 14 days of purchase under "cooling off" rules.

Some insurers may let you change the period of cover or refund you if you are no longer able to travel.

Many providers offered refunds during the coronavirus pandemic, as travel was restricted and holidaymakers had paid upfront for trips they couldn't go on.

You would need to check directly with your travel insurance provider if you can get money back.

Source: Read Full Article