Fans of the Netflix series “Inventing Anna,” which chronicles the rise of con artist Anna Sorokin, may have noticed an intriguing guest star: Cisco phones are used prominently in at least one episode. If advertising giant Interpublic Group has its way, more advertisers are likely to get those sorts of cameos.

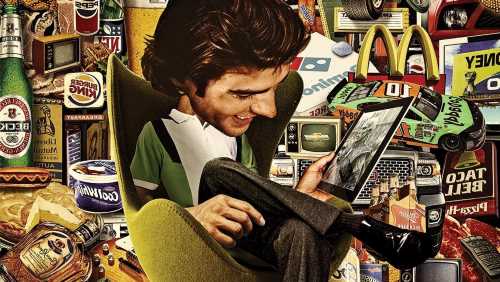

Two companies under Interpublic’s umbrella — the Rogers & Cowan PMK entertainment-marketing operations and the large Mediabrands media-buying unit — are teaming up to launch a new analysis-and-database product that helps advertisers determine what movies, TV programs and streaming series will serve as a good fit for in-show product placement. The new technology, known as UpstreamPOP, debuts as Madison Avenue grows increasingly concerned about how to get its products and messages in front of consumers as they gravitate to venues like Netflix, Disney+ and Hulu, which typically show fewer commercials than traditional TV — and, in some cases, none at all.

“More people who are 18 to 34 saw the most recent ‘Spider Man’ in its opening weekend than watched the Super Bowl in that demo,” says Mark Owens, the chief executive of R&CPMK, in an interview. Big advertisers eager to show off their wares have to work harder to get “inside the content,” he says. Digital influencers may be able to get a product and talk about it on TikTok in a day’s time, he says, but in-show placements that help deliver a promotional message can take weeks or months to craft.

Interpublic’s new service will contain information on more than 2,000 brand integration opportunities across original content that is in development but isn’t supported with traditional ads, including film, television, music videos and more. Each entry will be augmented with data about the type of audience the program seeks to attract, potential actors attached and the consumer demographics to which it would most likely appeal. Interpublic expects to bring some of its ad-tech operations, which can help an advertiser determine how much value the product placement had depending on the kinds of audiences that engaged with it, into the mix as well.

Interpublic does not intend to offer the service or the data to the general market, only to its own clients.

With the launch, Interpublic will be tilting at an interesting rival. Branded Entertainment Network, controlled by Microsoft founder Bill Gates, has been offering similar services for years. In recent years, it has helped weave vehicles from General Motors into Netflix’s “House of Cards” and Jose Cuervo into “Fuller House.” The Interpublic executives believe their advantage comes from tapping into the company’s base of dozens of existing clients, which include Verizon and Coca-Cola, which they believe will be eager to use the new offering. In a previous stint, Owens worked for Corbis Entertainment, the predecessor company to BEN.

“The holy grail is that we would have enough interest from the brands that we could go to an HBO Max or a Disney Plus and say, ‘We have this pool of money and these kinds of brands for you, and want to do a higher level deal,” says Owens. UpstreamPOP launches just as more streamers are looking to do more work with Madison Avenue, after a period of resistance. HBO Max has launched an ad-supported product, and Disney+ is about to do the same. Even Netflix, which long railed against the idea of running commercials on its service, has signaled its interest in doing so after running into choppy waters in the stock market.

The practice of weaving advertisers into shows has been around since NBC launched “Texaco Star Theater” in 1948. And the technique has grown more widespread and sophisticated over the decades, as anyone who saw Pepsi integrated into a storyline of the Fox series “Empire” or witnessed characters who work in an ad agency on ABC’s “Black-ish” receive an assignment for State Farm might tell you.

Creating those moments has become more crucial, says Brendan Gaul, global chief content officer of Mediabrands. “We are there to get brands in front of the people they are trying to reach,” he says. “The media landscape is fragmenting, and we can’t buy audiences in the way we used to.”

Many of those aforementioned product placements come about as a result of deals between TV networks and advertisers that can take months to negotiate. And yet there are other ways of getting cans of soda and specific smartphones on screen. Advertisers often reach out directly to production companies and set designers and dressers to insert popular goods. In 2008, for example, PepsiCo was able to get cans of the sparkling fruit beverage Izze into episodes of “Grey’s Anatomy” by doing just that.

“The real entry point is with the production companies,” says Gaul. “If you have a relationship with the showrunner, with the creators, and the brand is enhancing the property in some way — if it’s making it better, bringing a sense of authenticity to a character, it’s able to bring in some gap financing to enhance the soundtrack or add a level of graphic treatment, our experience is that even the least brand-friendly platforms are on board if the content is going to be better for their audiences.”

The executives expect more advertisers to place new focus on getting their goods on screen in this way, “This generation wants to consume their content in a ‘non-pitched’ way, so showing someone driving a car, or using a credit card or drinking a beer – that’s a critical part of the puzzle,” says Owens.

Source: Read Full Article