In August last year, Selfridges launched its new sustainability-focused Project Earth initiative. The launch, which included a range of new pieces from sustainable brands, featured the eye-catching announcement of a permanent space for the fashion rental platform HURR. It was a mainstream crossover moment for HURR and the wider fashion rental industry.

The idea underpinning the model is simple: the customer pays a relatively small amount to ‘rent’ a garment for a weekend, holiday, or occasion. It provides a more affordable, accessible and sustainable alternative to the cycle of buying and disposing of items.

It’s popular, too. The burgeoning market (which, until now, has largely been geared towards women) has reported a series of eye catching figures over recent years, pointing toextraordinary growth. By Rotation’s user base more than doubled between March and September last year, while Rent The Runway — a U.S. based service — was valued at $1 billion USD in 2019, although this did eventually dip.

Brands themselves also got in on the act: Levi’s and Ganni launched a rental-only collaboration in 2020, while H&M also began to explore launching a service.

“Clothing rental is a great way to extend the lifespan of quality garments, as the most sustainable clothes are the ones already in circulation.”

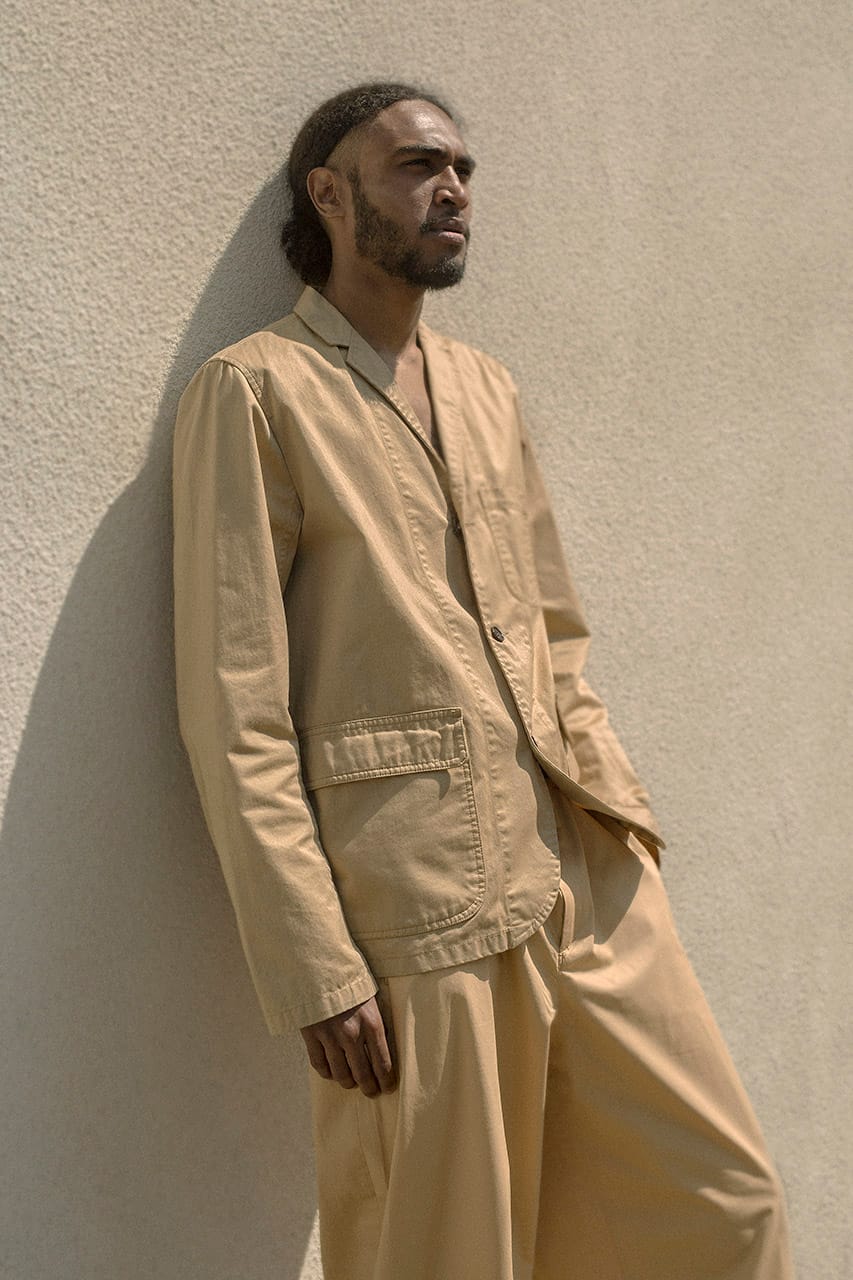

So far, though, the menswear market has been underserved. Recently, however, that has begun to change, as new platforms fill the gap in the market. Second Outing describes itself as “the U.K.’s first peer-to-peer menswear rental platform,” and works by connecting owners of designer items directly to those wishing to rent them.

“Clothing rental is a great way to extend the lifespan of quality garments,” explains Second Outing co founder James Martin, “as the most sustainable clothes are the ones already in circulation.” For Martin, this growing industry offers huge opportunities to customers as well as the platforms. “It’s important for us to clearly explain the benefits of rental,” he adds. “Such as earning money from your wardrobe, wearing designer clothes for a fraction of the selling price and shopping more sustainably.”

Womenswear rental platforms have been driven by occasionwear and bags, creating a potential stumbling block for menswear services trying to emulate that success. “We believe occasionwear will be a big reason for men to rent, too,” says Martin. “We expect the more obviously-branded pieces to be popular, such as logo shirts, sweatshirts and belts, as these are often a key part of men’s “going out” outfits.”1 of 5

Second Outing2 of 5

Second Outing3 of 5

Second Outing4 of 5

Second Outing5 of 5

Second Outing

Whereas Second Outing operates on a peer-to-peer basis, MY WARDROBE HQ also works directly with brands. The company, founded by Sacha Newall in 2018, originally focused on womenswear, but moved into menswear earlier this year through a partnership with Belstaff. “We allow brands to offer their items for rent and resale for overstock,” explains Newall. “You’re reducing the capital cost for the renters, giving access over ownership. You get to try multiple items, put everything on your social media, wear lots of garments, but you’re spending a lot less than when you’re buying. For the brand, your return is a lot better because you’ve extended your audience.”

MY WARDROBE HQ’s decision to move into menswear was driven by the number of men signing up to the platform. A third of the 77,000 people on the company’s database were men, all of whom were looking for something different to the traditional tuxedo rental. “We wanted to be sure that we worked with brands that were very much outside of that category,” Newall continues, highlighting Belstaff’s “Built for Life” slogan and sustainable credentials. “The idea is essentially a try-before-you-buy. You get a Belstaff jacket to try, and then you’re not going to buy 20 of the fast fashion equivalents.”

The company is expanding its offering through its recently-launched MY VENTURES, which allows brands themselves to launch their own rental or resale platforms. The decision to create this white label product has been driven by brands themselves, who are keen to take ownership of their goods as they enter the secondary market. “They’ve seen what happened in retail, as it grows 25 times faster than the regular retail market, and they’ve seen how fast rental is being adopted,” explains Newall. “Now they’re saying they want to be a part of this.”

“You reduce the capital cost for the renters, giving access over ownership. You get to try multiple items, put everything on your social media, wear lots of garments, but you’re spending a lot less than when you’re buying.”

MY VENTURES will mean that rental and resell can become a part of the brand’s in-house offering, sitting alongside more traditional retail avenues. “It’s to empower brands to offer rental and resell on their own site under their own branded experience,” adds Natalia Pawlak, MY VENTURES’ Chief Operating Officer. “You won’t think you’re going off to an external site for rental or resale, you’ll be able to do it in their own domain. The resale business is so detrimental to luxury brands, because once an item is sold, that brand never sees the commission, it never sees any recurring revenue from it. Every time a Chanel handbag or a pair of Jordans get resold, how do Chanel or Nike continue to see revenue from that?”

While established brands have been embracing the resale space for a while now — just look at Gucci’s partnership with TheRealReal or the strategic investment in GOAT by Groupe Artemis, the holding company behind Kering — the involvement of the rental market from these major players could catalyze the industry. Both Second Outing and MY WARDROBE HQ believe that menswear rental will be an important frontier as the industry grows.

“I absolutely think it will continue to grow,” Newall says of the market. “The speed with which its been adopted is much faster than even we’d anticipated. The fact that we had over 25,000 men sign up to our database shows that there’s interest and scope for it.” Martin agrees, believing that the success of womenswear rental shows where the menswear space can go. “The growing trends towards womenswear rental and second-hand shopping are promising signs that more men will begin to gravitate towards this way of consuming,” he says. “The menswear demographic is still largely untapped, and the potential for growth is huge.”

Source: Read Full Article